Be a part of Value Administration Options for a free 30-minute Digital Hedging webinar on Wednesday, Could 29 at 10 a.m. CT. Register here.

Dealer’s Nook, a weekly partnership with Cost Management Solutions, analyzes propane provide and pricing traits. This week, Mark Rachal, director of analysis and publications, discusses alternatives and guarding too carefully towards potential threats with regards to shopping for propane provide.

Compensate for final week’s Dealer’s Nook right here: Conflict of the titans: Propane manufacturing and exports

We wish to take you again to the Dealer’s Nook written on April 12 and launched on April 15. It was entitled “Trying ahead to subsequent winter and past.” On the day that article was written, Mont Belvieu ETR propane closed at 81 cents and Conway at 77 cents. They’d closed at 86 cents and 81 cents, respectively, one week earlier than.

We made the next assertion, “With the latest pullback in costs, values look higher for the winter of 2024-25 however nonetheless a little bit expensive. Pricing for the further-out winters appears higher.”

Later within the article, we stated, “Nonetheless, between now and the tip of June, we should always anticipate a number of the greatest propane values based mostly on historical past. Over the previous 5 years, front-month propane has averaged round 74 cents throughout Could and June. April has averaged round 78 cents, so the chances favor placing our plans collectively over the subsequent couple of weeks and start executing them within the upcoming couple of months.”

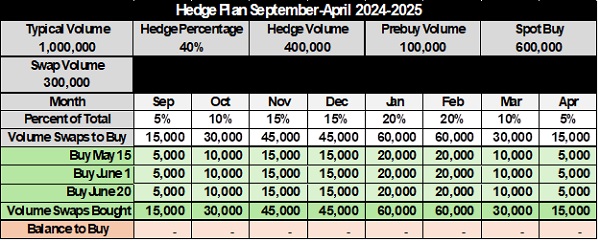

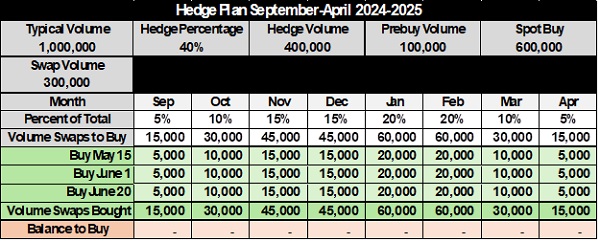

In that article, we went into much more element in regards to the thought course of that goes right into a hedging program and used Chart 1 as an example how that may look.

Chart 1: Hedge Plan Sept.-April 2024-2025

Notice in Chart 1 that we had been shopping for in Could and June to fill our hedging objectives for September via April.

It has been fortuitous for consumers over the previous few weeks since that article was written that propane costs have continued to fall. As we write on Thursday night, Could 2, Mont Belvieu ETR propane simply closed at 72.625 cents and Conway at 70 cents. These values are throughout the place Could and June have averaged in the course of the previous 10 years, so we all know we’re in a a lot safer shopping for zone.

Hedges made two weeks in the past would have been paying a premium to the 10-year common propane worth for many months. However now, as we glance out over the subsequent three years, there are solely a handful of months the place that will be the case.

As well as, propane has fallen underneath its 200-day transferring worth common. Historical past suggests that purchasing when that’s the case tremendously will increase the possibility of the hedge being favorable. Additional, propane’s worth relative to WTI is at or under the bottom we’ve seen for this time of 12 months going all the best way again to 2001. Usually, buys made when propane is valued low relative to WTI have a better likelihood of being good.

We identified in latest Dealer’s Corners that this downturn in costs has been aided by sturdy propane manufacturing and a drop in crude’s worth. Propane inventories are close to five-year highs largely as a result of surge in manufacturing. Manufacturing got here down just a bit in the course of the week ending April 26 after setting new information two weeks in a row. Nonetheless, it’s a sturdy charge, and with inventories already excessive such a excessive charge might very effectively result in propane inventories setting five-year highs in upcoming weeks.

In order good because the previous two weeks have been for consumers, there could possibly be extra draw back for costs, so that’s the reason layering in provide as within the instance above is a good suggestion.

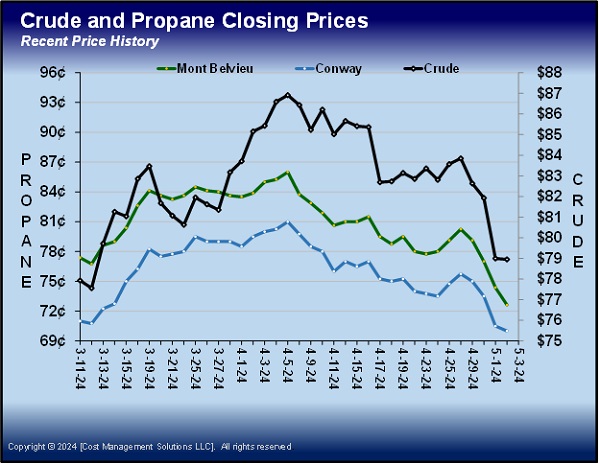

We additionally shouldn’t underestimate the influence of the sharp fall in crude’s worth since April 8 on the favorable costs we now see in propane. Propane’s flip decrease precisely corresponds to the decline in crude’s worth.

Chart 2: Crude and Propane Closing Costs

Crude has been tumbling on issues for the worldwide financial system and extra lately as a result of Hamas and Israel are at the least contemplating phrases for a ceasefire once more.

Part of the financial concern was an uptick in inflation. It appeared inflation was underneath management initially of the 12 months, and for a number of months the expectations grew that the Federal Reserve would begin reducing rates of interest in June. Then inflation ticked up, and the Fed took the June charge minimize off the desk. Subsequently, there was one other spherical of regarding inflation inflicting hypothesis that the Fed might increase rates of interest much more. That precipitated extra concern for vitality demand and have become a heavy weight on crude’s worth.

On the conclusion of immediately’s (Thursday, Could 2) Federal Reserve financial coverage assembly, Federal Reserve Chairman Jerome Powell was requested if the Fed might increase charges. He advised strongly that the subsequent charge change is much extra prone to be a minimize, although he acknowledged that such a minimize will come later than the Fed had anticipated. That assertion all however took a charge hike off the desk. It precipitated a giant bounce increased in U.S. equities markets. Crude markets didn’t reply a lot, however we’re betting after we get up within the morning (Friday) that crude costs will likely be up.

If crude begins a rally on this improvement after which ceasefire talks between Israel and Hamas break down, crude will doubtless retrace a few of its latest decline since these two elements are largely liable for it. A rally by crude would doubtless pull propane costs out of their decline as effectively. If these items ought to come to fruition, a propane purchaser would possibly wish to get that first layer of worth safety earlier than the chance that has been introduced over the previous two weeks evaporates.

Once more, we’re acknowledging that propane fundamentals should not supportive with the excessive manufacturing and already-high inventories, so we in all probability don’t wish to be overly aggressive, however we additionally don’t wish to let this dip get away with out our full consideration of whether or not it’s the proper time to take that first layer of provide for subsequent winter and even past.

On the one hand, there are a whole lot of good-buy alerts for propane. Lots of the containers are checked, which will increase the chances that buys will likely be favorable. When that’s the case, we merely shouldn’t ignore the chance. But, we should be cognizant that propane fundamentals might turn into even much less supportive of propane’s worth. We have to handle that risk by layering in provide in the course of the purchase window via June. And if fundamentals are weak sufficient, the purchase window might keep open past June, which is extra purpose to layer in our worth safety over time and in addition depart loads of quantity to be purchased at market costs come winter.

As consumers, we should always all the time be monitoring developments that may have an effect on crude’s worth and propane’s fundamentals and let these developments information our diploma of aggressiveness. How inventories are prone to pattern constructing as much as winter ought to turn into clearer over these subsequent two months.

However we merely can’t let the concern that costs might go decrease dictate our each choice, as a result of that risk will all the time be current. If that concern drives a purchaser, then many, many good shopping for alternatives will cross by. None of us can know the longer term, and the unknown all the time feels threatening to any choice we make within the current. We all know alternatives after we see them within the current. If we don’t act on them, we frequently don’t get them again sooner or later. However, the reality is, most of us are pushed extra by unknown future threats than recognized present alternatives.

Principally it’s as a result of we concern being fallacious. However what we’ve witnessed so many occasions through the years has been that those that let concern stop them from making the most of alternatives will sooner or later discover themselves in a rising market. They may assume their opponents took benefit of the alternatives. That concern will typically trigger them to purchase at precisely the fallacious time, on the high of the market.

Guarding towards giving an excessive amount of weight to unknown threats and never sufficient weight to recognized alternatives has a better-than-equal likelihood of enhancing our charge of success.

All charts courtesy of Value Administration Options

Name Value Administration Options immediately for extra details about how consumer companies can improve your corporation at 888-441-3338 or drop us an electronic mail at [email protected].